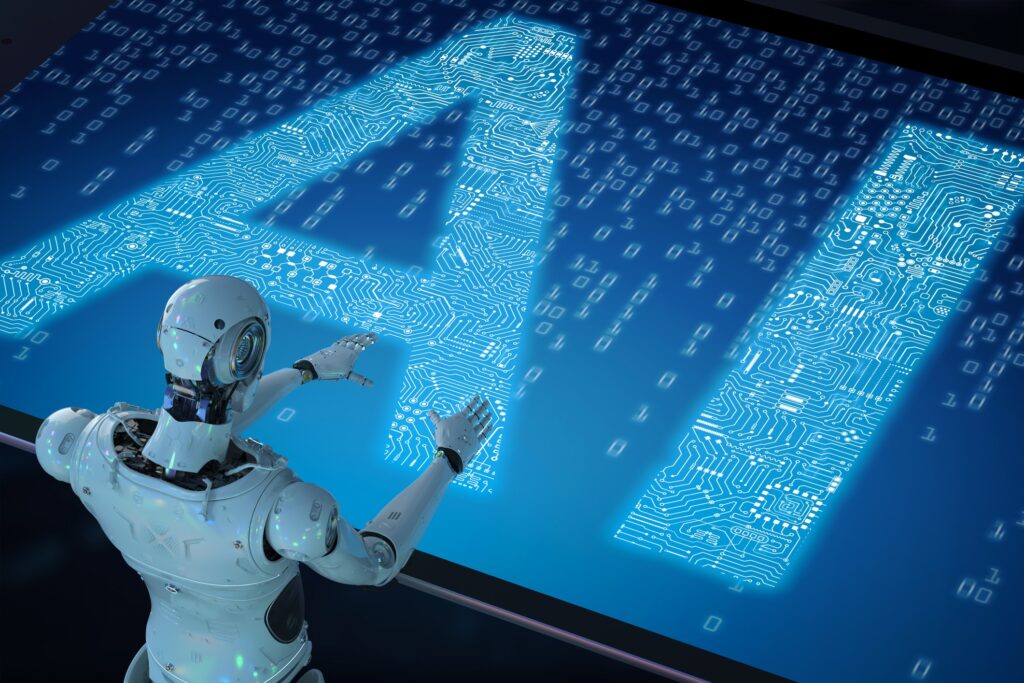

Now Reading: Big Tech in panic mode Did DeepSeek R1 just pop the AI bubble?

1

-

01

Big Tech in panic mode Did DeepSeek R1 just pop the AI bubble?

Big Tech in panic mode Did DeepSeek R1 just pop the AI bubble?

Stay Informed With the Latest & Most Important News

Previous Post

Next Post

Loading Next Post...